In our monthly check-in with the Cirium team, we explore the recent growth of ultra-long-haul flying and consider the headwinds that could impact its expansion.

With the increase in activity across the airline industry pre-pandemic, new flights and routes were developed and stage lengths increased. It is now more common than ever for carriers to offer travel to destinations that would be considered ‘ultra-long-haul’. Analysis from Cirium’s Diio airline planning system had shown an increase in such flying up to 2019, but has the COVID-19 crisis impacted this trend?

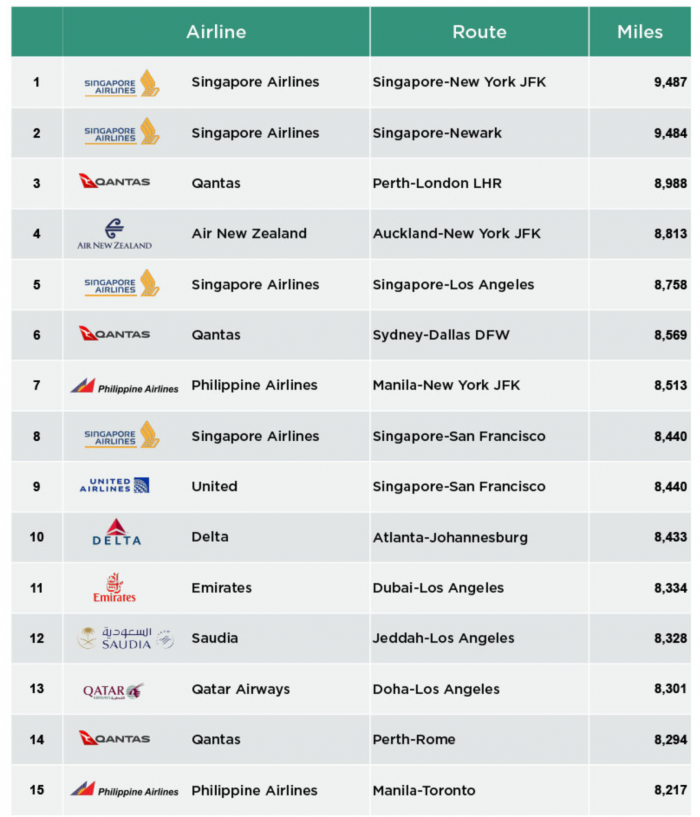

Ultra-long-haul routes are classed as those exceeding 8,000 miles or have a duration of more than 16 hours. Geographically, this type of flying is most frequent for journeys to and from the Asia-Pacific region, with ASEAN countries, Australia, and New Zealand routes being the most common.

Growth in context

Of all scheduled flights worldwide in 2019, 30 routes exceeded 8,000 miles, and this growth has been a steady incline. Compare this figure to 2015, when there were 17 routes exceeding 8,000 miles offered by airlines. In 2005, there were only six such routes, all of which involved either Singapore, Bangkok or Hong Kong. By 2010, that number had risen to ten.

Singapore Airlines’ flight from New York/JFK to Changi is currently the world’s longest airline service. Clocking in at approximately 19 hours, the 9,487-mile distance is flown with an ultra-long-range Airbus A350-900. In fact, Singapore Airlines as a carrier has contributed significantly to these statistics – five of their routes from their Singapore hub are classified as being ultra-long-haul: Newark, Los Angeles, San Francisco, Seattle and New York/JFK.

The chart (see further below) highlights the 15 longest routes based on mileage and the carriers that provide them. The growth of ultra-long-haul flying can be attributed to various factors, such as developments in aircraft technology. The introduction of longer-range products such as the Boeing 787 Dreamliner in 2014 and the Airbus A350 in 2015 have made tackling significant distances far easier and much more comfortable for customers and crew.

Additional factors

Other influences have also contributed to these increased route distances. With economies recovering from the pandemic, deregulated markets and the increase of globalisation, these farther destinations are made more accessible and desirable to the rest of the world. With the rise of Middle Eastern carriers such as Emirates, Saudia and Qatar Airways (all seen in the chart), more hubs and fleets can support new intercontinental routes.

While the growth of ultra-long-haul routes showed a steady rise until 2019, the devastating impact of COVID-19 on the aviation industry has also been reflected in Cirium’s set of post-pandemic statistics.

As the travel industry recovers, Cirium has recorded that, during the July-September quarter of 2022, airlines had 22 routes of at least 8,000 miles. This is a decrease from the 30 routes that airliners provided in 2019. The axed links include Doha to Auckland, Dubai to Auckland and Houston to Sydney. This makes United Airlines’ San Francisco to Singapore non-stop service the longest North American route.

Industry rebound

However, in 2022, four new non-stop routes that exceed 8,000 miles were added. These comprise the Singapore to New York/JFK service, Qatar Airways’ Doha to San Francisco route, Perth to Rome with Qantas and Air New Zealand’s Auckland to JFK link, which was launched in September.

With these additional flights being included and the efforts of services such as Qantas’ Project Sunrise utilising the longer-range A350-1000s, the future for ultra-long-haul routes continues to look promising. Similarly, Boeing is keen on extending the range of its popular 787-10s. Cirium predicts that the number of ultra-long-haul routes will return to a pre-pandemic growth trajectory thanks to these developments, both planned and proposed.

However, as with any aspect of the aviation industry, the future of ultra-long-haul depends to a large extent on the price of fuel. As we know, Russia’s invasion of Ukraine has pushed up costs around the world, which has added to the economic pressure airlines are facing. These very long flights become much more feasible if fuel is cheaper. With the current geopolitical war in Europe and growing concerns about an economic downturn, only time will tell if ultra-long-haul flying can become commonplace for airlines and their customers.

For more insight visit cirium.com